Read, Listen To, or Watch My Newest Article!!!

“A CoVID Perspective On Finance”

Continue Reading the Full Article Below or linked here…

https://www.orgoneknights.com/post/a-covid-perspective-on-finance

#freedom #KnowledgeIsPower

You can Listen to the Full Article Read By Author here…

https://soundcloud.com/dancing-beyond-cancer/a-covid19-perspective-on-finance?in=dancing-beyond-cancer/sets/interesting-articles-for

Or Watch Heaven’s Angel Andora Read the Article…

Part 1 – https://youtu.be/RDMHZgJXkPM

Part 2 – https://youtu.be/lwGqjTv3o6k

#cutedog #lockdownactivities #quarantineactivities

It still is hard to believe a decade ago that I was working in Finance as a clean-cut suit and tie business guy. Especially, since I now have long hair, ride a bicycle, and make pyramids with crystals in them. I’m sure most people thought I lost my mind at the time and many might still believe that. However, finance was great until I ended up learning too much, then everything changed. I had to be true to myself, and selling products for a fundamentally broken system was Not my calling. I hope to share some of my personal experience to help others during these times of high financial stress, while also sharing some interesting Perspectives about Finance.

To start, I initially began by running my own financial office after the 2008 crash. I decided to get involved in finance after I turned $1,500 in stocks into $20, through a series of incredibly bad trades. Sadly I was not very successful as a financial planner either as I learned most people in the world were broke. However, I was very successful in helping with debt management and helping to educate people to get back on their feet. The statistics a decade ago, were 50% of Americans are 2 weeks away from being homeless, meaning that Today many people, without help, are technically homeless. I was faced with that stark reality a decade ago, and it was eye-opening!

I learned that most of the people I knew were Broke! People who made $100K a year were spending $110K, while people who made $50K were spending $55K, and so forth. Everyone was spending more than they earned, and credit cards made it all possible. Honestly, I don’t think things have gotten better for most people over the past decade, just more debt and higher interest rates. Now people are facing something I struggled with 10 years ago. After struggling for nearly two years to run my office and digging myself into an ironic financial pit, I broke.

I was at an all-time low as I was months behind on my mortgage, wasn’t able to pay my car payments, and was always struggling to pay my bills. The Subconscious Poverty mindset was laid down in cement for me, so I caution people about falling into poverty or “woe is me” mindset right now. Now is the time to act even when all things seem lost. Otherwise, you may end up in a state of sadness, depression, or inaction that is incredibly difficult to break free.

That happened to me a decade ago, with several similar experiences as I started my new companies. Only recently, I feel the poverty mindset has been replaced with a mindset of abundance, and now I haven’t worried about my finances in several years. Sadly I am still not financially “rich” but definitely not broke either. After years of stressing about how I was going to pay bills, make rent, or even feed myself, it has been a significant relief. It took a lot of inner work and effort to get to this point, but honestly, it was worth every bit of the journey—even the worst parts.

While working in finance, my bills were outrageous as I was paying for a house, a shared office, a rental home, a car, insurances, investment deposits, and had only one tenant renting a room in my house which was located out of state. I was making practically Nothing, and my bills were over $3,000 per month. Hardly an excellent place to be if you are a financial advisor.

It may have been my Pride, but I persisted through the struggles burning through all my savings. There was an All is Lost Month, not a moment but a month, where I just didn’t know what I was going to do. Today I feel many people are going through this All is Lost Month, right now. It was crippling and debilitating. I didn’t want to go into the office, as I didn’t want to face the other people in the office. However, we are being forced to do this today. It made me feel like a failure, despite all my previous efforts. I had only taken Sunday’s off as I held events every Saturday. I still kept going to the gym and social events, hoping that something would manifest.

It just so happened that it did, because I had faith it would work out. It just wasn’t how I expected it or wanted it. I didn’t want to end up broke and struggling before the miracle happened, but it would be one of the best learning experiences of my life. Now I’m glad to have those experiences as tools to avoid ever ending up in that place again.

At the end of my, all was lost month; I was offered a job working for one of the most revolutionary privately owned retirement firms in the country. That was the stability I needed at that time. It was through my connections at the gym I went to daily that I received the job offer, my persistence paid off, not with clients but with a better job. It was wholly unexpected, but because I had a Series 65 financial license, he was particularly interested in bringing me aboard. He offered me everything I could have asked for, and I took him up on the offer. Leaving my office and team of financial planners, I moved on to greener pastures. The decision to move on was difficult and invigorating at the same.

My New Boss taught me how to find all the hidden fees, tricks, and scams that investment vehicles use, which put retirees at risk. I was confident that he was genuinely doing the best thing for his clients, as he gave out most of the education for free. If you search retirement planning online, odds are his videos will pop up first. We were compensated when Educated People used us to invest, which happened quite often. The Boss even showed me how to tear apart investment vehicles that I used to sell at my old office. I couldn’t believe the hidden fees and lack of CLEAR Disclosures that most of the investment vehicles contain.

It was Even more Eye-Opening when he told me about the hidden fees and hidden catch inside the investment product that I had put my parents into. I even hired my dad into the previous company to teach him about finance and we still never knew the hidden catch. There were things that people just aren’t being taught, including the advisors. So when I had this new opportunity to talk to people all across the country and spend hours a day educating them about what they have, I was in heaven. It felt like a calling.

I felt I was helping so many people and even helped to better educate my dad on how the products work. While I’m not saying all investment vehicles are bad, I am saying that Most People, even the people who Sell them, Don’t Know EXACTLY What They are Buying or Selling. This lack of financial literacy is why we had the 2008 collapse, which is still leading into the current economic meltdown, but more on that later.

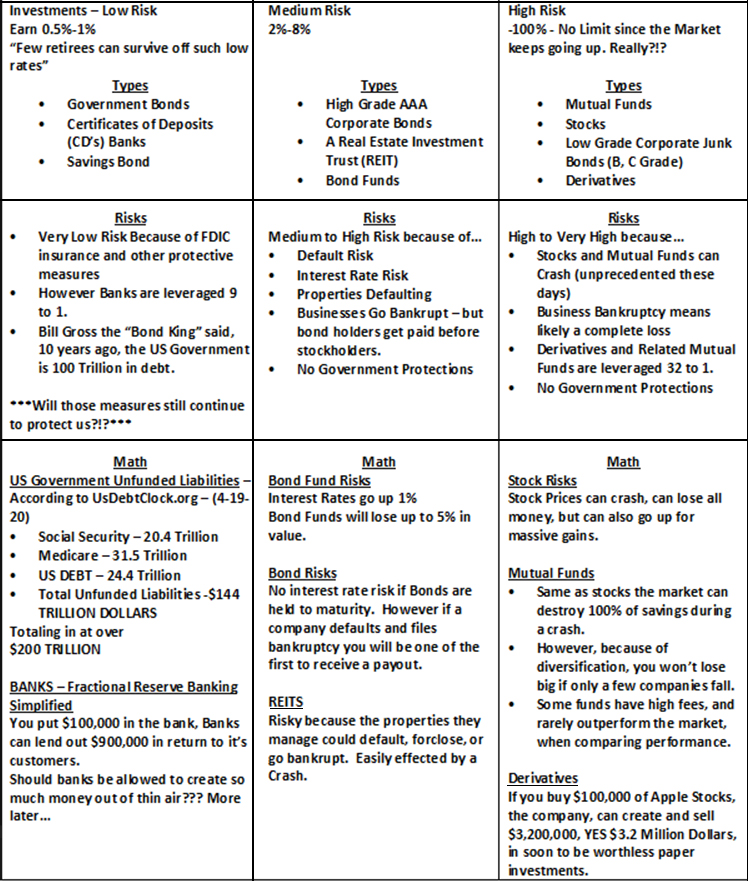

I initially started in finance to educate people on simple principles like the Rule of 72 and how to start to save for retirement. Now I was discovering that there was really only one safe investment for most retirees. The reason was because most “Safe” Investments like government bonds, savings bonds, or Certificates of Deposits (CD’s) don’t return enough interest, and now with interest rates dropping to 0% it means that retirees are even more Screwed, to put it lightly.

The problem then is, if “Safe” Investments don’t have high enough returns, what else can you do? I could recommend the next level up would be High Grade Corporate Bonds, Real Estate Investment Trusts (REIT), or Bond Funds. These all have much higher payouts. The problems are with the risks. Currently we have seen big bubbles burst in Tech and Housing, however these aren’t even the biggest looming bubbles. That was when my boss put things into Perspective, and he would illustrate it as such…

I hope you caught the last part about Derivatives. Warren Buffet, one of the wealthiest investors on the planet, described Derivatives as “Financial Weapons of Mass Destruction.” I completely understand when you understand a simple principle. Just like Banks can Lend out 9 times what they have in deposits, hence the term Fractional Reserve banking. They only have to keep a fraction of the money in the bank or on hand, because they have discovered how to create money infinitely.

The investment banks, using Derivatives, can leverage up to 32 TIMES. This means that for every $100,000 in assets these investment banks have, they are lending out up to $3,200,000, and yes, that is Millions of Dollars, to ignorant investors. Which is one Huge reason I’m writing this paper.

The derivative market is a bubble of which we have Never seen, and one huge reason I left finance. Since the top 10 banks have over $500 Trillion Dollars in derivatives, it is probably something that we, as a society, should understand. The Global Gross Domestic Product (GDP) is only $85 Trillion!!! Considering that if everyone cashed out of the system, there would only be 3.125% of the money left over, which should scare most people. (MATH – 100% / 32 Leverage = 3.125% Principle Amount)

Take a look at the past, when Lehman Brothers collapsed in 2008, only 1% of the money was returned to investors. Lehman was supposedly leveraged 100 to 1 by the time it collapsed because the value of the assets had dropped so much. A short market downturn destroyed their measly 3% in reserves, and there wasn’t anything left. However, during this time, many of the banks that caused that to happen received Trillions in Bailouts. While the American Public suffered because they trusted their leaders.

SIDE NOTE We should consider most of Congress Creatures because they are vile people, especially when they increased their net worth between 20%-40% on AVERAGE, During the 2008 Collapse!!! They should all be in Jail for that alone, but I continue…

The problem banks are currently having has to do with the REPO markets, which spiked in October 2019. (Coincidentally at the same time the reported virus was Released, and this is honestly a big red flag for me) However, there was a time this past October when the REPO rates spiked to over 10% from a standard of 1-1.5%. What does this mean? Well, considering it was Lehman Brothers who started the crash in 2008 by borrowing money in the REPO market from the FED, aka Federal Reserve. The FED, by the way, is about as Federally Owned as Federal Express, aka “FedEx.” The FED is a private banking cartel that is supposed to watch over and stabilize the markets. Instead, they seem to manufacture crashes, but I’ll have to save that for another article.

The REPO markets are for banks who have extra cash at the end of the day to lend to banks who need extra cash at the end of the day. This is to maintain those reserve requirements that I was just discussing. So if banks are required to keep 3.3% in reserves, then sometimes they must borrow money to maintain those reserves. (SPECIAL NOTE RESERVE REQUIREMENTS ARE NOW CURRENTLY 0%, YIKES!?!) However, returning to the past, if a bank doesn’t seem reliable, then banks won’t want to lend to the risky bank. Hence why the rates spiked in October to 10%. Unlike 2008 we are seeing the problem being papered over, literally.

When Lehman had to borrow from the FED in 2008, all hell broke loose, and we saw the orchestrated 2008 collapse. Now 11 years later, in October 2019, we had the same event happen, but no real reaction from the markets. The Markets even posted all-time highs shortly after this event. This was signaling that everything is Awesome, Nothing to See here… This FED intervention has been a stealth bailout. Instead of identifying the weak banks that caused the interest rates in the REPO market to Spike to over 10%, the FED stepped in to offer All Banks assistance. They also made sure NOT to DISCLOSE the banks that were at Risk, as to prevent any Bank Runs on the Risky Banks.

The FED Proceeded to provide nearly $75-100 Billion Dollars a day to banks as they quietly went through the crisis, Which Still has NOT ENDED, technically they reduced reserve requirements to 0% which means banks can leverage money indefinitely, which is both wrong, and further destroying the economy, assuming they haven’t already gone too far…

When we look back at the results of the 2008 collapse. We start to understand that the 2008 collapse did something significant to the banking industry when we saw the merging of Major Banks and Investment Banks. The mergers were done to keep the cash reserves up in the banking industry. Bank of America swallowed Merrill Lynch, and now we have JP Morgan Chase. I distinctly remember the banks offering to move people’s money to mutual funds or bond funds after that time, and I believe they got in trouble for this, but you would have to look that up. This means that banks were transferring assets from a 9 to 1 debt creation system to a 32 to 1 debt/derivative investment system.

We should truly be frightened when we start to understand that the FED was providing assets to banks to keep 32 times leveraging afloat with $75 Billion Dollars a Day. (MATH – $75,000,000,000 x 32 = $2,400,000,000,000) Yes, that number is $2.4 Trillion Dollars. That is assuming a worst-case scenario, but it means that they have Potentially around $2.4 Trillion Dollars in bad investments that could bring down the ship.

I believe this is where it starts to get very interesting, and I want to start putting more numbers in Perspective. You may want to re-read this paper after I explain these facts. If you took a Trillion Dollars and spent a Million Dollars a Day since Jesus was Born, you would only spend about 3 Quarters of that amount of money. Now take the estimates of the Derivative Market which is, Sadly Unknown, but still reported to be between $750 Trillion and $2.4 Quadrillion Dollars. Yes, you read that right, the estimates range by over 1,000 Trillion Dollars, which is a crime in itself, but let us put that in Perspective.

If you had a Quadrillion Dollars, ONE THOUSAND Trillion Dollars, you could literally spend One $BILLION Dollars a Day, with 9 Zero’s, for 2,000 years and still not spend the full amount!!! This is how much FAKE money the FEDERAL RESERVE and Central Banking System has created since 1971, when we went off the Gold Standard.

Now with the understanding that the banks have Potentially $2.4 Trillion in bad assests, does the $2.2 Trillion dollar coronavirus bailout seem a bit too, exact. They are even asking for $2.7 Trillion for a full corporate bailout, which is closer to covering my $2.4 Trillion estimates. It frustrates me that the bailout is going to people who have created the problems in the first place, and the manufactured problems always seem to be naturally creating the solution, a solution that everyone seems to think is helping them. Remember the Patriot Act if you honestly believe that good measures come out of tragedy. That was simply manufactured terror for the purpose of stealing basic human rights, and they won 20 years ago. However, the powers that “were” will Not win this time. Too many people are doing their part, as this is my part to add.

My problem with a $2.2 Trillion Dollar bailout for the banks is that most small businesses and individuals won’t see a cent, as I am discovering from most of my artist family and the small business community. The sad truth is when we look at the numbers, it is a criminal system that pays $2 Trillion in taxpayer money to stimulate the economy while only providing $1,200 – $3,600 to those very taxpayers. There is even some serious concern over $450 Billion given in private loans to Large Corporations. Lets put Finance in Perspective and do some fun numbers…

While I would never expect the government to offer the full $2.2 Trillion to the people as that would just be irresponsible, it should make you consider something important. What happened to the other $14,400 per taxpayer? Is it right to put that amount of debt on every taxpayer? The money is being stolen from the people and being given to the companies with the most lobbyists?!? Sadly, Many of the current bailouts are based on lobbying power, and guess what? The American People are not Directly paying those lobbyists.

We pay corporations with our purchase votes, and those corporations pay lobbyists, who lobby in favor of the corporation. Most corporate lobbyists write and submit the laws that our politicians pass. We have little to no voice in Washington, as the numbers above show. I think that is the most essential part to understand, We are Being Taken Advantage Of. Poverty is not a matter of numbers, but where those numbers go. What if every American was a Millionaire? Would the rest of the world benefit from that abundance? Think about it, it could have been possible, had we kept our riches…

The lack of financial literacy has pulled the wool over the heads of most people. People are too afraid to discuss the topic of Money as they believe it is wickedly complicated. I want you to know that they make sure things are complicated to hide the wrongs that are occurring. These devices they have been pushing as investments may be having their final days, as I had foreseen nearly a decade ago.

It is strange times we are living in, and I can’t deny the uncertainty that the future will bring. I hope that the more we educate ourselves, the less likely we are to end up in the same situation again. If we are more prepared in ourselves, in our communities, and our world as a whole, then I feel we can face any adversity with universal positivity.

However, we can’t keep allowing ourselves to be robbed by our “leaders.” The FEDERAL RESERVE, in cooperation with our government, have been stealing from the people for over a Century. As I watch small businesses struggle to find loans and money to stay afloat, I realize this is far more an attack on individuals and their small businesses. Many companies have already closed, and they are estimating 20-40% of companies may close by the end of the year.

If we allow them to bail out just the large corporations, then when this is all over, that is what will be left. We are passively letting those corporations rule us, and by allowing them to put profits over the wellbeing of our planet, we put ourselves at extreme risk. Many trade agenda’s and carbon taxes clearly show that they want to protect profits more than the people. We must protect the people and ourselves from those who wish to do us harm. It is all being put on the table, and we have the opportunity to do something about it or allow ourselves to be ruled by criminals. What will we choose? I personally think we should throw most of them in Jail, but that’s just my opinion.

After struggling with keeping my own businesses successful for a decade, I understand the stress it brings. It isn’t easy to start and run a successful business these days. We have far more businesses struggling versus thriving, especially now. It will force us to reevaluate what is important. Many people will foreclose on properties, as I did on my house. Many people will stop paying unnecessary bills, and people will allow their credit scores to tank. I will let you know I did all of this, too. I defaulted on many bills during my times of struggle a decade ago. It didn’t ruin my life, and it didn’t cause the banks to come after me, although the phone calls were a bit annoying. That lasted until a debt management company I formally worked with, also helped me settle my debts.

I was able to survive. I was able to make it through the hard times, and eventually, I was able to rebuild a credit score, although I don’t use it except for emergencies. I find I save more money by saving up and paying off my purchases, as we all used to do before credit cards. Now, I don’t have excessive bills, and managing my expenses is not a monumental task, as I have simplified my life dramatically. There was little need for my excesses, and it took going through hardship to realize what was excessive and what was important to me. I think this process will be different for everyone, and it will be up to you to decide what is essential to you…

We live in an upside-down world that I believe may have just been turned right side up, but seeing the potential depends on your Perspective.

#EndTheFed #aCoVIDfinancialPERSPECTIVE #finance #FED #FederalReserve #Criminals #crash #homeless #poverty #BailOut #Banks #marketcrash #investments #Derivatives #truth #financetruths #financialtruths #ProsperityForAll #life #story #hardship #WeAreInThisTogether #CoVID19 #covid #virus #lockdown #quarantine #freeUs #freedom #KnowledgeIsPower