First of all, I would like to emphasize, I’m not an expert, nor my words are strictly for casual chat basis, and are not taken into your financial decision nor consideration. I’m not here to compete with any other expert, majority of these knowledge are my own experience which big portion of them are not sourced, and not being study before. If it somehow resemble the the concept from internet source, simply because someone think the same and the method being used are coincidentally resemble.

On our previous episode, we have touched the surface of futures, and briefly understand why has it gone negative, because the oil itself does not physically go below 0. The value gone below 0 is the future contracts. People who couldn’t afford to take delivery. Today’ we will have to come back to WHY somebody are forced to take delivery. SHORT SELLING, is the general concept in CFD trading(contract for difference). Let us first understand the behavior and later we can take advantage on it.

SHORT

First of all, if you’re not a veteran trader, you probably doesn’t have the knowledge of short selling. In option, it’s SHORT CALL. It happens widely across many financial tools, which involves in SELL first buy back later. Let’s have a look at future market, that happens -36 few days ago. Why is it happening? We’re going into two different type of situations.

HEDGE

Here’s a situation, where business investors is trying to protect their own product. In this case, petroleum refinery, which their end product is gasoline/petrol, whereas their raw material is crude oil. What happened is, if crude oil price drop, they will be expect to lose profit on their final product. So, the business owner short hedge the crude oil with future contract. What happen is, at stipulated date if price goes up, they lose money on the contract, but their petrol/gasoline price is up, so they get more profit from the sales . On the other hand, if price did fall, they gain from the contract earnings, whereas the actual product will face a heavy price cut. So, the profit from the contract should balance off the loss from the sales.

SHORT SELLING

This is more of a speculator game. You know I don’t have an oil rig, how can I sell crude oil? So, basically I don’t sell the oil, but I sell the contract. Which I promise someone who take my contract at $40, later I will buy it back at whichever price it is with the same amount of sales I made earlier. Still don’t get the idea? Ok. I short sell a CFD, on a piece of PAPER. That piece of paper stating 1 barrel of crude oil, at 10:00am April 17, 2020 the price was $40. Few days later on April 21,2020. Oil price fell to $19. I buy it back with $19, so the broker will have to pay me $21. This is how sell first buy back later come to play.

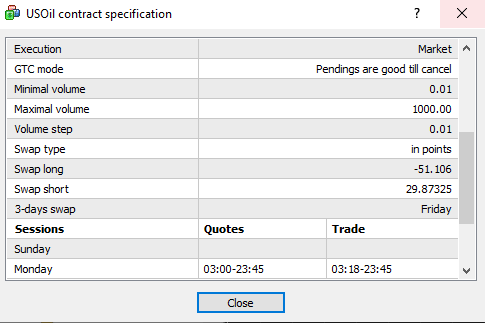

SWAP

Now this is something we don’t usually see. This is the APR we always referred to. I’m sure there’s more technical explanation to this, but let’s keep things simple before people falling asleep. This is very important because we need to understand, CFD is only a contract, no physical delivery is involved. And therefore, short selling could yield a positive APR swap sometimes. Imagine, when you buy these CFD contract, you don’t really own the oil, but someone will have to take the risk to own that oil for you. If they didn’t buy that physical oil, in the end if price really goes up, they’ll have to forkout money from their own pocket and pay to you so they can take back the CFD contract from you. It’s like a gambling ticket. Same goes to the other way round, when you short selling, which means you don’t really own a barrel, but someone have your contract. If price really goes up? Remember back in previous crisis in 2008 where oil price shoot up to $148 a barrel? Can you imagine if you’re shorting a $19 contract? You’ll have to forkout $129 to buy back the damn contract. Good thing is, because you’re supposed to “hold” the barrel, be it you have or do not have the barrel, you’ll be paid with positive swap, to help keeping the barrel for your buyer. I may be wrong, but this is my understanding and the concept is not far from what I’m saying I believe.

How can we take a ride?

Like @chekohler discussed on my previous post, imagine when those who start to take delivery of GOLD, they’ll be so happy! Well, that usually does not happen. Nobody have that amount of real gold being traded on line. You don’t wanna buy a CFD contract and hope to receive a container worth of physical gold. The biggest trouble is, the before the truck manage to reach your house, there’s chance that it got robbed, and you’re left with a piece of purchase invoice. So, here’s the simple idea, the -36 dollars fall is due to the swap, we already took a ride earlier, by buying back the spot market at spot price.

21/4/2020

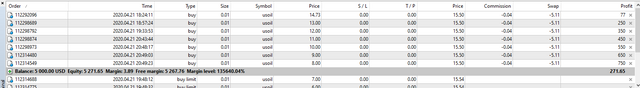

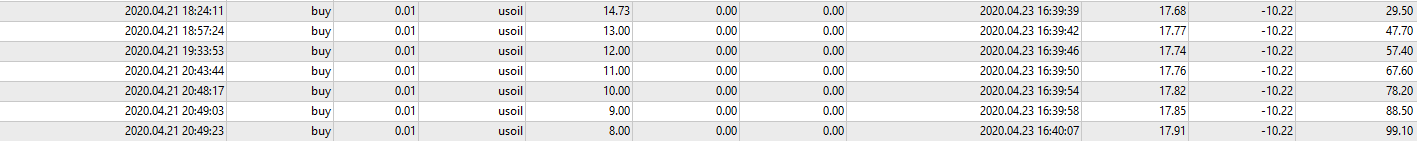

https://steemitimages.com/640×0/https://files.peakd.com/file/peakd-hive/davidke20/tEqzU0TN-image.png

We parked the buy orders on sport market. Incase the price fall further, we will capture the buy orders on the way down. Note that we will be paying swaps.

22/4/2020

1 day rolled over, 7 of our orders has been triggered despite I parked them 1 dollar apart interval. This is only 1 day, and we’re paying more then $5 for each oders.

23/4/2020

2 days rolled over, 7 of our orders has been in some good profit. We managed to closed them all. There are potential to go further, but it’s time to look for something new.

Fundamental

Remember the future market? It’s in a great down trend for crude oil for several reason which I think it’s not a secret. When I say it out, you will say to know you knew it all. But that’s not our argument today. We’re here to make a quick buck, so let’s take this with an open mind.

- The virus thing, causes economy slow down.

- Production slow down, industrial needs slowing down

- Less productive, less transportation required

- Future hedge that involved delivery now become unsustainable because, low demand, if take more delivery, who is going to consume the end product?

Ok. I have closed all my buy positions, I’m going to take the sell positions now starting from $18. You see, short is a very risk move, because my profit region is only $18 down to 0. No matter how bad it can go, it can only go down to 0. But my losses, could be unlimited, on the upside.