Amid an overwhelming technical defeat, Wall Street turned its gains with the shares of major technology companies falling, and the most important US stock indexes turning red during the year, on their way to closing in the red in 2018, adding to concerns about slowing growth and trade tensions .

The Nasdaq Composite Index for high-tech stocks fell by 2.5% in early trading, approaching its lowest level in seven months, while the S & P 500 index decreased by 1.8%. The Dow Jones Industrial Average fell more than 2%, or nearly 500 points.

After the group of five shares of FAANG – belonging to the technology sector, represented by: Facebook, Amazon, Apple, Netflix and Google alphabet – combined more than $ 1 trillion in its market value from its recent highs, in trading last Tuesday.

FAANG Group shares started the trading session on Tuesday low. Apple led the group’s losses, dropping 4.8%. Looking ahead, more and more investors may start taking profits, amid current market conditions.

Shares of the Five, which had been the preferred investments over the past decade, were closed in a bearish market on Monday. As Wall Street sets the bear market down 20% or more from the 52-week high.

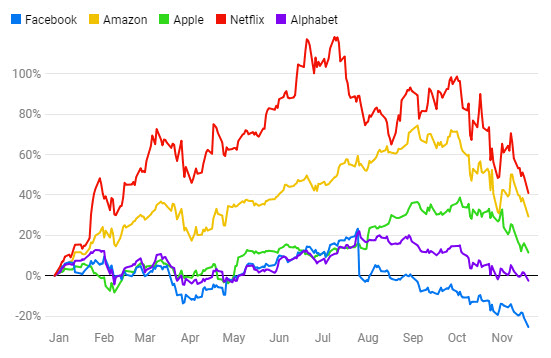

FAANG shares are down from 52-week highs

FAANG shares drop from 52-week highs: percentage change from 52-week highs to Tuesday trading for each of the five FAANG stocks.

Despite the strength they are forming, the value of losses in the market value of the five accumulated FAANG shares from their 52-week highs to Tuesday reached an estimated $ 1.02 trillion of their recent value, as detailed below:

Facebook: He lost $ 253 billion.

Amazon: Lost $ 280 billion.

Apple: Lost $ 253 billion.

Netflix: lost $ 67 billion.

Alphabet: Lost $ 164 billion.

Based on losses from each company’s rising point in recent months, more than $ 1 trillion of market value has been lost. Facebook, Apple, and Amazon have borne the biggest losses.

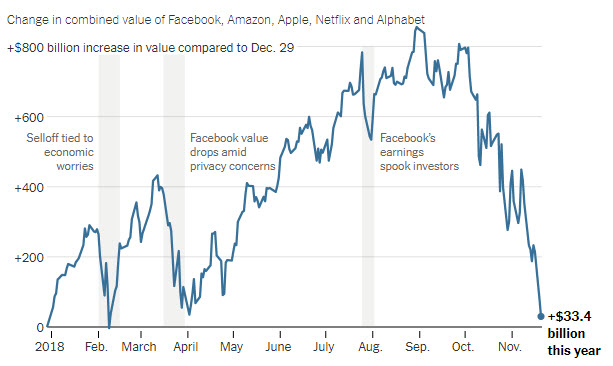

The change in the combined value of Facebook, Amazon, Apple, Netflix and Alphabet

Change in the aggregate value of FAANG shares during 2018.

So, in the midst of all this turmoil, let’s take a look at how FAANG stocks helped to drop the market.

Much has been blamed for what happened to Apple, which saw its share price drop by 4.8% during regular trading last Tuesday, to $ 176.98 per share. And Apple’s latest decision to stop announcing iPhone unit sales in the future helped in the company’s recent sale.

Goldman Sachs cut its Apple share price forecast on Tuesday by more than 11% after announcing weaker-than-expected quarterly earnings and store sales themselves ahead of the holiday season. She said in her report:

There is a weak demand for Apple products in China and other emerging markets, as well as a disappointing iPhone XR model reception.

The Wall Street Journal reported on Monday that the world’s largest technology company has cut production orders in recent weeks for all three of its new phones, which were unveiled in September.

While Facebook shares fell by 40% from their highest levels, as a result of a series of negative news that have befallen the company since the summer of this year, especially the focus on the company’s senior executives manipulating the Russian influence on the 2016 elections in the United States.

While Amazon stocks continue to fall on the back of its fourth-quarter forecast on October 25, which was much lower than expected. Meanwhile, Netflix and Alphabet shares fell significantly with the rest of FAANG shares.

While Facebook and Alphabet both hit 52-week highs in July, at \(218.62 a share and\) 1291.44 a share, respectively. Netflix net profit in June was \(423.21 a share. Amazon and Apple were the most recent to reach a 52-week high of\) 2,550.50 in September and $ 233.47 a share in October, respectively.

FAANG shares lose more than $ 1 trillion

Cumulative return of FAANG shares separately during 2018.

Mark Hackett, Head of Investment Research at Nationwide, said:

Last week saw a pullback after a solid two-week trading period, as investors showed disorganized behavior consistent with the market’s bottoming. We saw similar activity in the spring of the year. This week will be interesting, as volume of trades is likely to be limited, causing exaggerated moves.

This is a notable reversal of one of Wall Street’s most popular deals. And represented by the accumulation of investors in the shares of the largest technology companies, betting that their revenues will continue to grow strongly, as these investors moved away from other stocks, from retail to communications to the media.

By August, Apple and Amazon had a market value of over a trillion dollars, and Alphabet was worth \(900 billion. With the combined market value of the five countries\) 3.6 trillion.

But worries about global economic growth, coupled with dull earnings and expectations over the past two quarters, have shaken investor confidence. In particular, concerns have escalated over the number of new iPhones that Apple will sell.

While Facebook spent much of the year steeped in the scandal, raising the specter that the United States government will tighten technology regulation. All this has stock investors wondering if the values of these big technology companies are in danger.

Let’s find that the investors swamped the group’s shares, and erased about $ 822 billion of its market value since the end of August.

Of course, the FAANG Group shares faced steep selling earlier, but they quickly bounced back, they may be overwhelmed, but as dominant as they always have been, their prices are always growing, and the risks are part of their equations.

In this year alone, the combined market value of these five companies declined by 7% or more during three separate periods. And each time, stocks resumed their path to new peaks within weeks.