The cryptocurrency market has seen many trends over the past few years and the latest one happens to be cryptocurrency trading bots. This concept is appealing because it offers numerous advantages that are all aimed at making trading significantly easier.

What are cryptocurrency trading bots?

Trading bots are a set of programmed instructions that are designed to perform specific tasks by following specific sets of instructions to achieve the desired outcome. In this case, cryptocurrency trading bots are digital tools that are designed to help the trader analyze the market. Sometimes they are used to automate trading so that they can execute and close trades, following a predetermined trading style or strategy.

How do cryptocurrency trading bots work?

Success needs a strategic formula and the same case applies to cryptocurrency trading or any type of trading for that matter. This means that the trader has to come up with a strategy based on various market conditions that he/she can predict to a high success rate that can sustain profitability. This means that every time the trader analyses the market, he or she will be looking for specific conditions and if those conditions are met, then the trader can execute the trade.

Bot trading means that you can use programming to create an automated system that can perform a specific aspect of your trading process or all of it. In other words, the bot or set of instructions can analyze the market on your behalf and notify you when the market conditions fit your trading criteria. Some push things further and create a bot that can execute when all the conditions match the criteria of the trading strategy. This means that the cryptocurrency trading bot can open and close a trade on your behalf, thus full automation.

Why you might want a trading bot and the type of trading bot you should aim for

Cryptocurrency trading bots can be designed to be highly accurate to the level that they eliminate human error. The latter is one of the main problems that many traders face when trading, and it ends up costing them a lot. If you want to avoid trading errors, then perhaps consider creating a cryptocurrency trading bot.

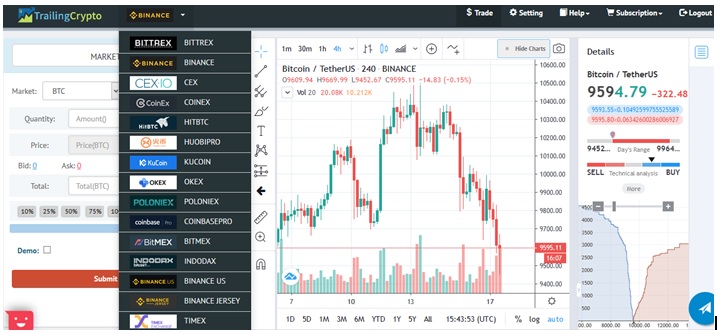

You might be interested in a bot if you have a solid strategy and you want to have more time to do other things but still make money. In this case, creating a trading bot might be a good idea but you would have to make sure it is a fully automated one so that it can run both the market analysis and trade execution. Make sure the bot is flexible enough to be applied to different platforms for maximum advantage. For example, a bot that can automatically adjust to switching between exchanges on TrailingCrypto might be handy.

A cryptocurrency trading bot may also come in handy as a tool through which you can reduce the work you have to do every day when trading. The bot can handle the market analysis on your behalf, thus simplifying your work. This option is ideal for those traders that still want to manually execute their trades. A fully automated bot will be more useful to a trader that is new to the market, thus someone who has little to no market knowledge.