Brief analysis of gold trends and some currency pairs on H4 time frame

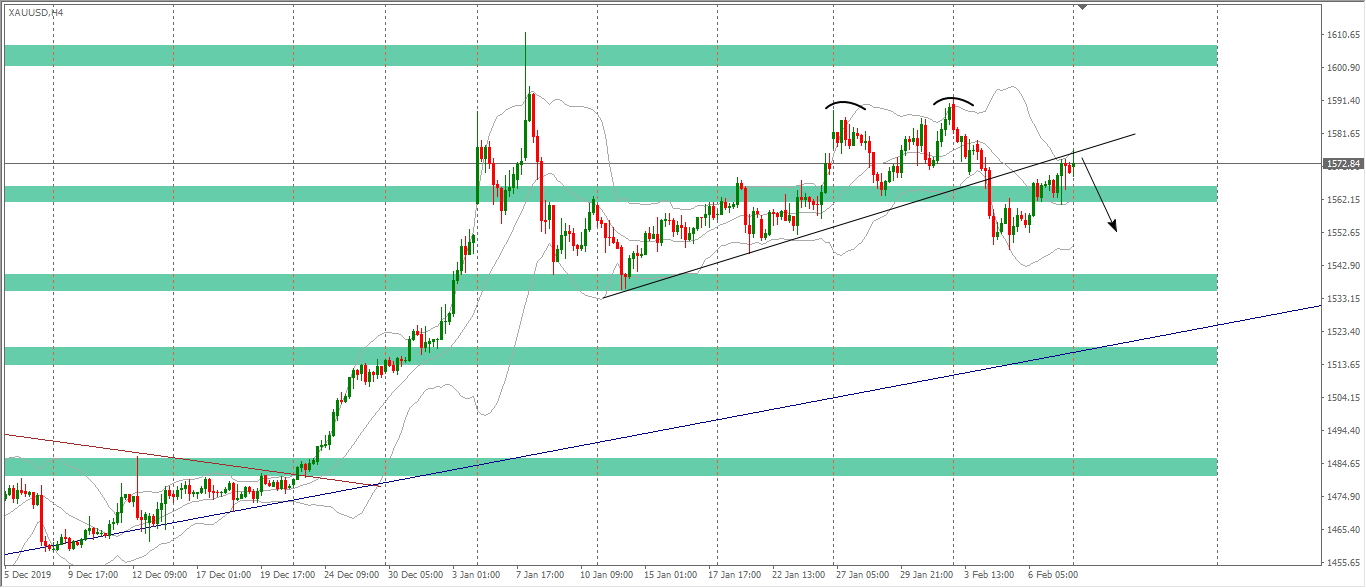

XAU / USD

When the price approached the trend line, it was rebounded about 100 pips and then rebounded to create a hanging man model (the weekly pattern also appeared similar but much clearer). Keep persisting on the short order, however SL should be placed right above.

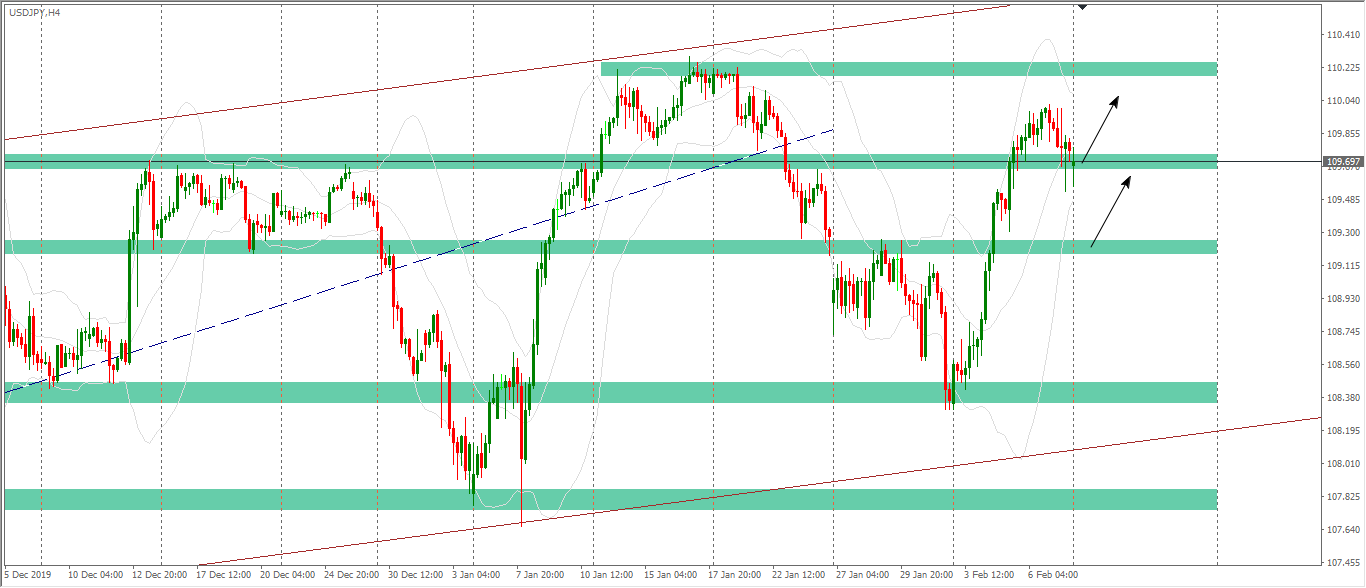

USD / JPY

The price bounced back at the noted MA20 zone and at the same time created bullish signals on both daily and H4. On weekly we also have a strong bullish engulfing pattern, so buy orders should be prioritized. The buying zone may be the current price level, if more careful then wait for a stronger pullback to the 109 area.

EUR / USD

EURUSD continues to move as expected, after retesting the 1.10 zone has plummeted to 1.093, currently the price has been very close to the bottom area for more than 2 years, so it is easy to reverse. Sellers should consider closing orders or at least moving SL, reversal brothers should pay attention to wait for signals to reverse.

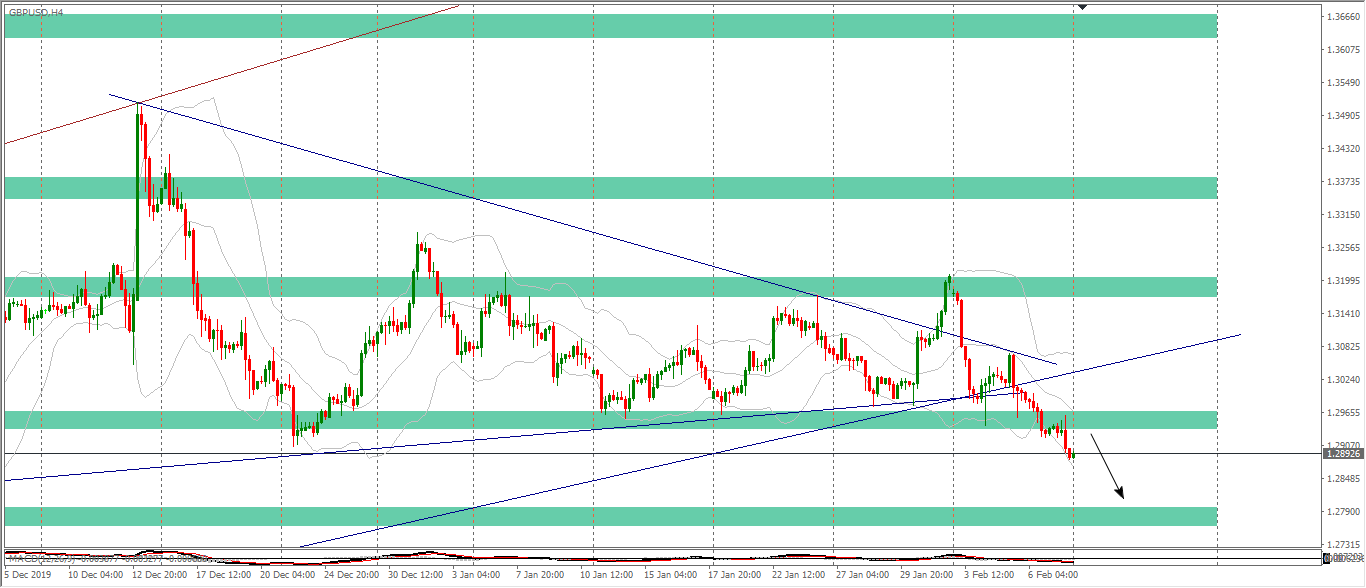

GBP / USD

GBPUSD has continued to go down, the most noticeable point on this pair is the bearish engulfing candle pattern appearing on weekly and the MA20 line there is also being broken, under lower frames, selling pressure is also overwhelming. . Therefore, we will continue going down, the target for this phase will be the zone of 1.275-1.277.

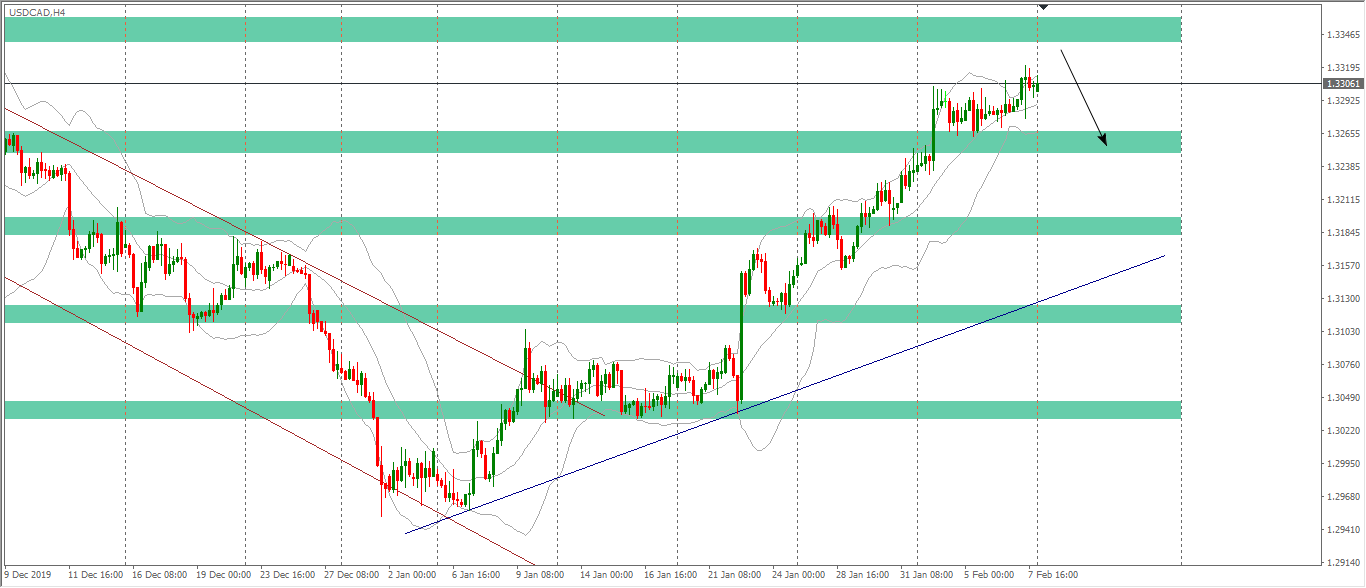

USD / CAD

In the last session of the week, although the USD increased strongly, the pair did not change much, showing that the resistance above was quite large. continue to watch the bearish signals to sell, do not buy now, pay special attention to the zone of 1.335.

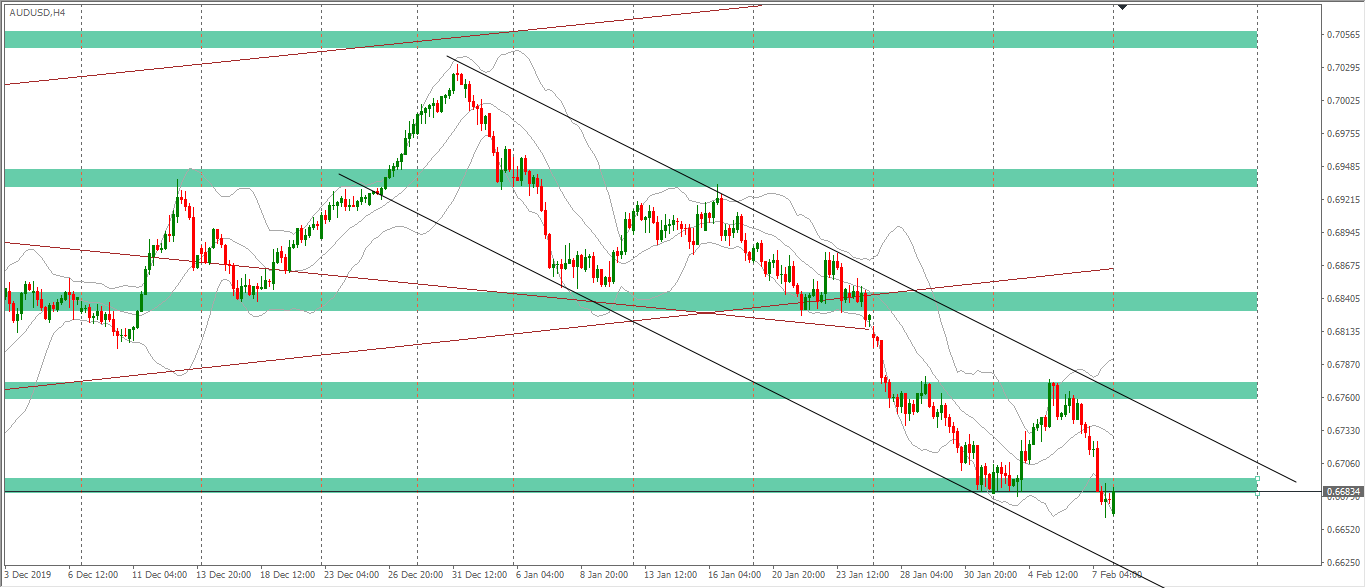

AUD / USD

The current price zone has a relatively large fluctuation range, so it can not be said that it has been broken. Moreover, a doji also appeared on H4, continue to observe this sensitive area, if any of you have bought and SL is not stuffed, waiting for the next price action to react.