Brief analysis of gold trends and some currency pairs on H4 time frame

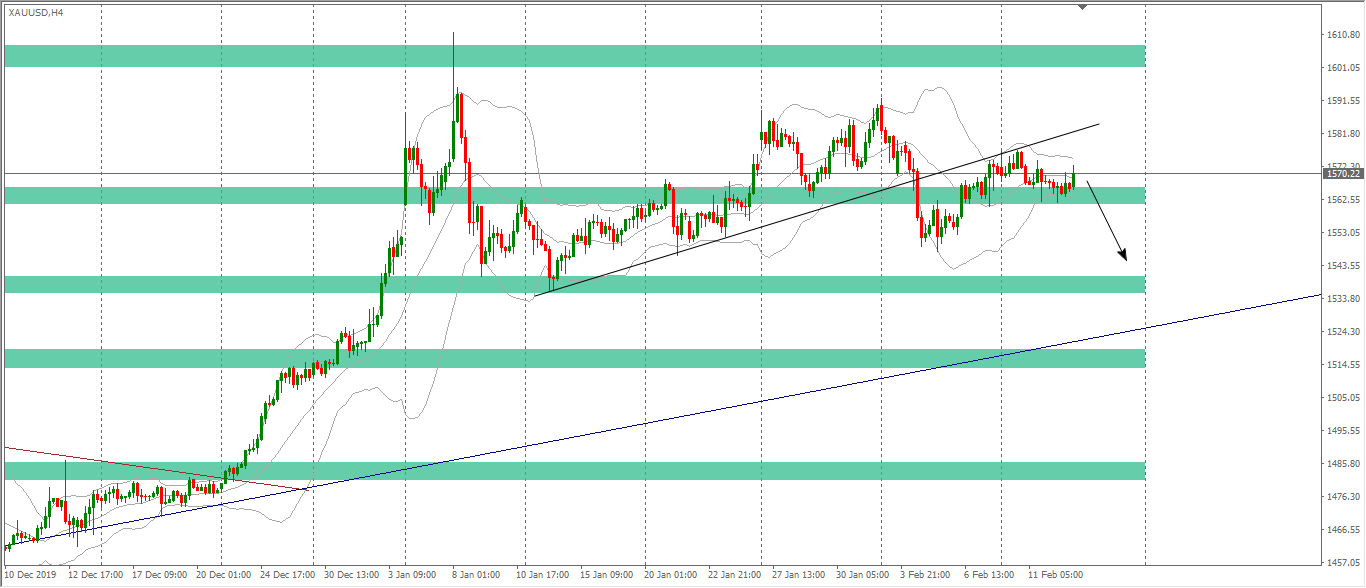

XAU / USD

Gold had an extremely low volatility session yesterday, the amplitude of the whole day fluctuated less than 100 pips, still hovering above the support of 1560. There were also no noticeable signals that caused our view to change. , continue to expect prices to go down, just enough SL to overcome the risk of unexpected price increases.

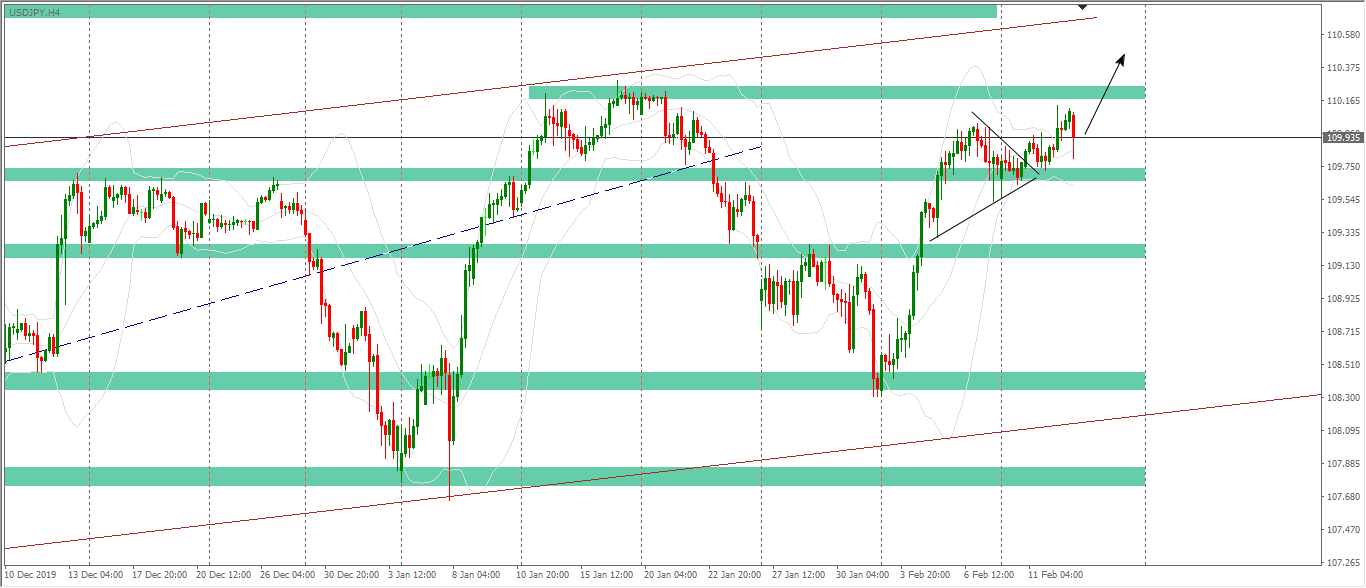

USD / JPY

Unlike USDJPY gold yesterday, there was a significant price movement, not a cumulative one. The triangle was broken, the breakout price approached 110.2 and then dropped. This is a strong resistance area, but the current price action suggests that the price may continue to rise. The brothers who have long orders continue to hold, move the SL, do not add new orders in this area because there is no signal breakout, moreover if there is a breakout, the price range is not much. The brothers who trade reversed, they should not rush into the order, waiting for the price to go further and have a clear signal of decline.

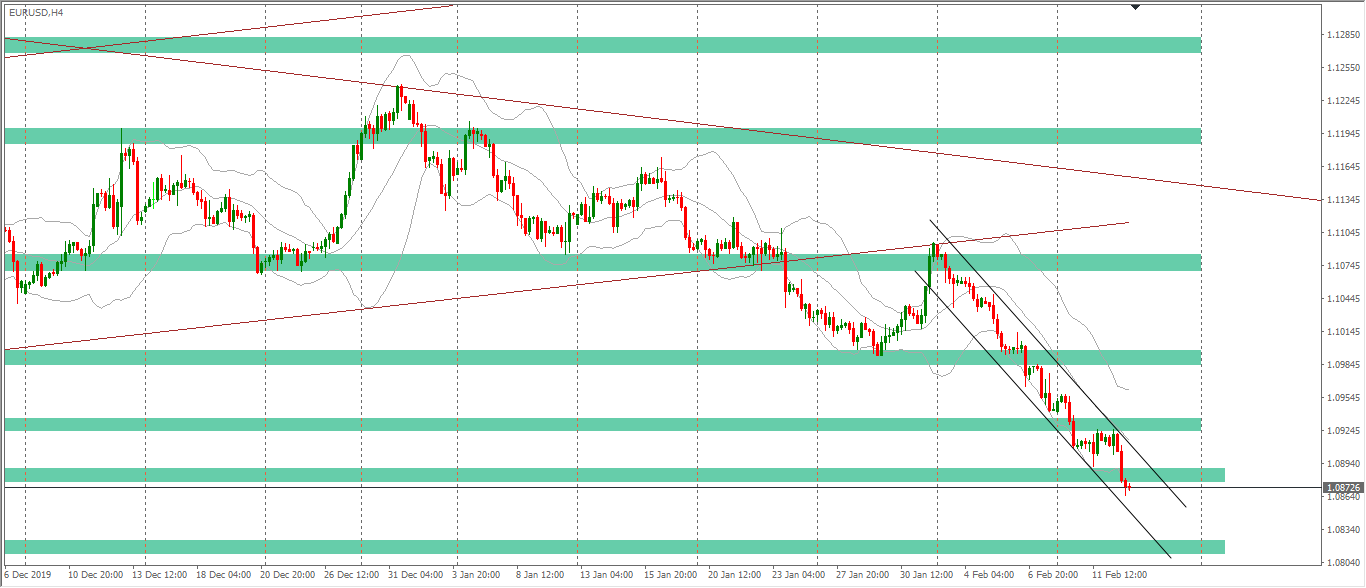

EUR / USD

The most surprising session yesterday was EURUSD, despite the simultaneous rising signals, the price still dropped and broke the lowest bottom in more than 2 years. At first glance, this is not like an SL scan, the selling is still strong enough to sustain at the new bottom. Therefore, absolutely not stuffed orders to buy this area, if missed SL then wait for the next signal to see stars. The area to pay attention to is the 1,080 zone. I also do not encourage short-term brothers because the market is in a state of oversold, heavy adjustment may come very strong.

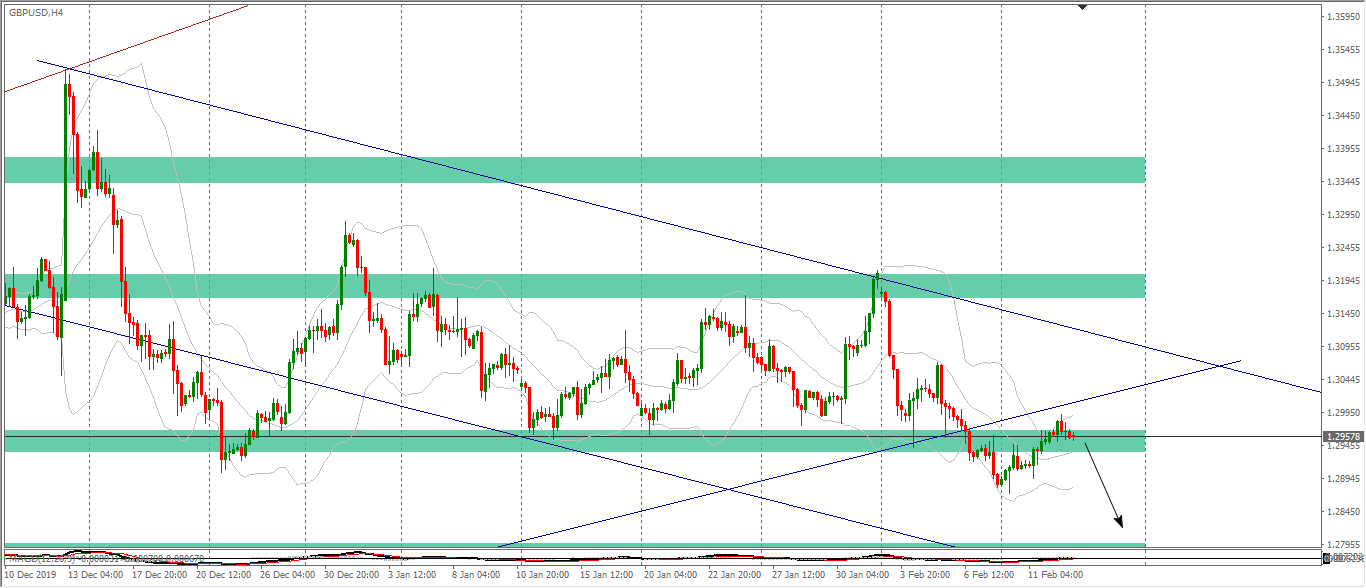

GBP / USD

The price doesn’t fluctuate too much but it is enough to create a bearish pin bar on the daily basis, although this signal is not really strong but it reinforces our bearish view. You keep prioritizing sell orders, the target will be the area of 1.275-1.277.

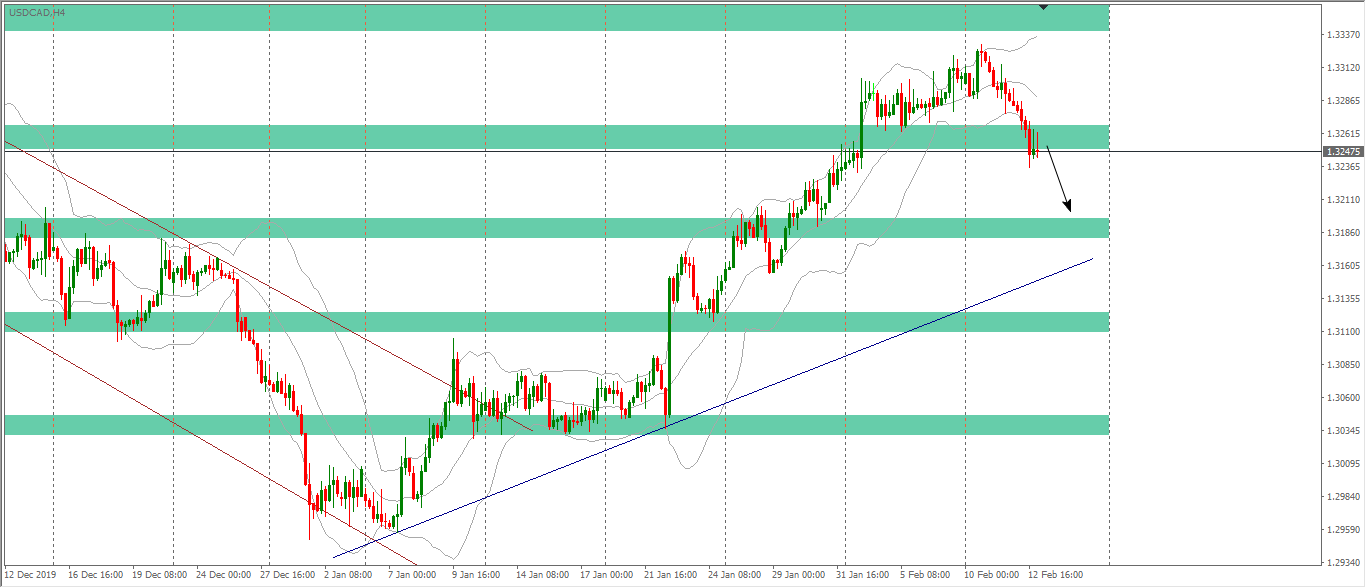

USD / CAD

The price dropped sharply as expected, the resistance at 1,325 was not strong, continuing to raise sell orders, it is likely to consider moving SL to reduce risks. The target is still the 1.32 zone, this is the confluence zone with MA20 on daily so the possibility of rebound is relatively high, brothers pay attention.

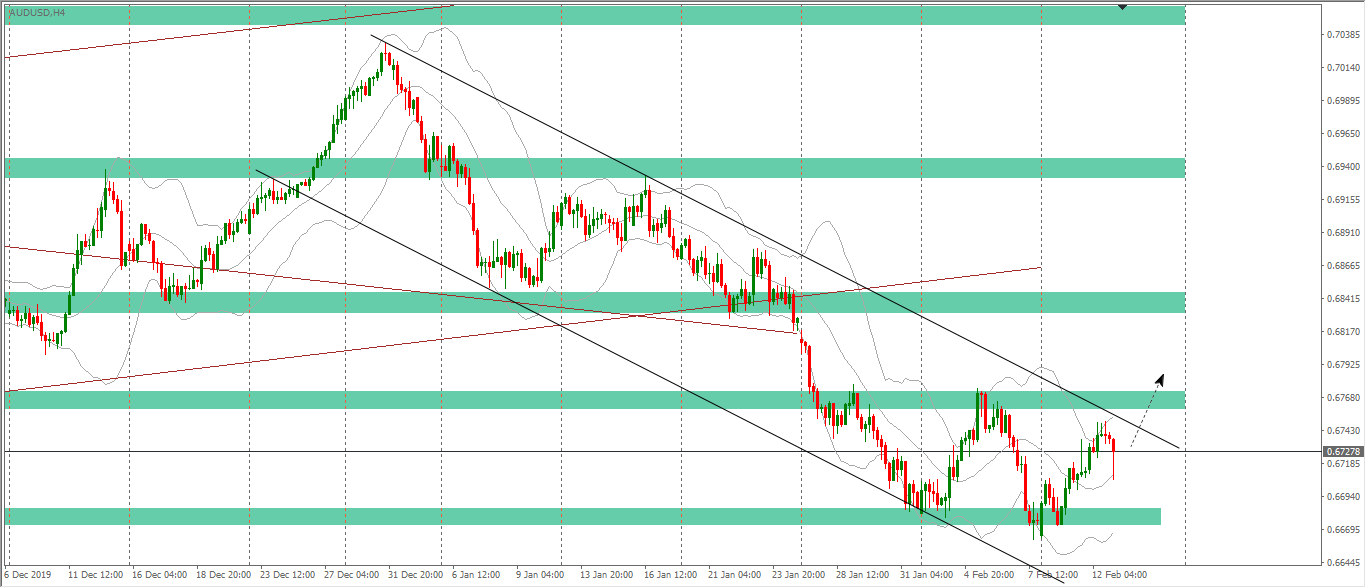

AUD / USD

The price is still going up, but it is being tested by the confluence of 0.675 and cannot escape the downtrend channel. Shortists should not sell this time because the signal is not strong enough and the possibility of a reversal is large.

http://www.fxprimus.com/open-an-account?r=38793622®ulator=vu